The Only Guide to Pvm Accounting

The Only Guide to Pvm Accounting

Blog Article

Not known Facts About Pvm Accounting

Table of ContentsThe smart Trick of Pvm Accounting That Nobody is DiscussingUnknown Facts About Pvm AccountingNot known Factual Statements About Pvm Accounting Rumored Buzz on Pvm AccountingThe Best Strategy To Use For Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Definitive Guide to Pvm Accounting

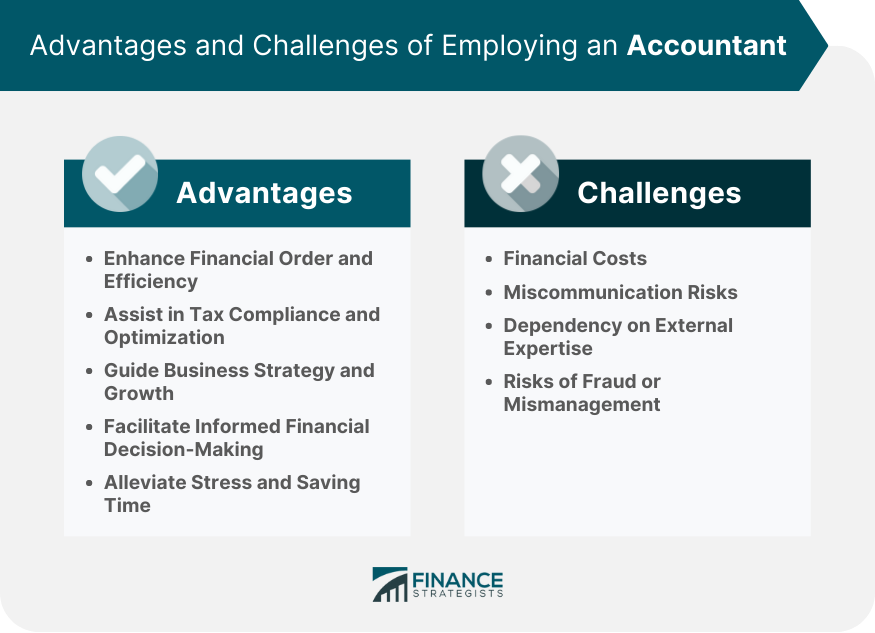

When you have a handful of choices for a little service accounting professional, bring them in for quick meetings. https://calendly.com/leonelcenteno/30min. Company owners have several various other obligations geared in the direction of expansion and growth and do not have the moment to manage their financial resources. If you own a small company, you are most likely to take care of public or personal accountants, that can be worked with for an internal solution or outsourced from a book-keeping companyAs you can see, accountants can aid you out throughout every phase of your company's development. That does not suggest you need to employ one, but the right accounting professional must make life simpler for you, so you can focus on what you love doing. A CPA can aid in tax obligations while additionally supplying clients with non-tax solutions such as auditing and economic encouraging.

Rumored Buzz on Pvm Accounting

Working with an accounting professional lowers the probability of filing unreliable documents, it does not entirely remove the possibility of human error affecting the tax return. A personal accountant can aid you plan your retired life and additionally withdrawl.

An accounting professional is a specialist that manages the financial health and wellness of your business, day in and day out. Every little service proprietor should think about employing an accountant prior to they in fact need one.

The 9-Minute Rule for Pvm Accounting

They'll additionally likely come with a useful professional network, in addition to knowledge from the successes and failings of organizations like your own. Working With a Cpa that recognizes https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ set property bookkeeping can effectively value your realty while staying on top of aspects that impact the numbers as time takes place.

Your accountant will also give you a sense of required startup costs and investments and can show you exactly how to keep functioning also in periods of decreased or negative cash circulation. - https://host.io/victoriamarcelleaccountant.com

An Unbiased View of Pvm Accounting

Running a small Get the facts business can be a challenging job, and there are various elements to track. Filing tax obligations and handling funds can be particularly testing for small company proprietors, as it requires knowledge of tax obligation codes and financial policies. This is where a CPA is available in. A Certified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) can supply indispensable support to little company proprietors and help them browse the complex world of money.

: When it concerns bookkeeping, accounting, and financial planning, a CPA has the expertise and experience to assist you make informed choices. This expertise can save small company owners both time and money, as they can count on the CPA's knowledge to ensure they are making the most effective economic selections for their organization.

Pvm Accounting Things To Know Before You Get This

CPAs are educated to remain updated with tax regulations and can prepare exact and timely income tax return. This can conserve small company owners from frustrations down the line and guarantee they do not deal with any charges or fines.: A certified public accountant can also help small service owners with financial preparation, which includes budgeting and projecting for future growth.

: A CPA can additionally supply important insight and evaluation for local business proprietors. They can help identify areas where the service is prospering and locations that require improvement. Armed with this details, little business proprietors can make adjustments to their operations to enhance their profits.: Lastly, employing a certified public accountant can supply tiny business owners with tranquility of mind.

The 3-Minute Rule for Pvm Accounting

Doing taxes is every honest resident's obligation. After all, the federal government will not have the funds to give the services we all count upon without our taxes. Therefore, everybody is encouraged to prepare their taxes before the due day to ensure they stay clear of charges. It's also suggested because you obtain perks, such as returns.

The size of your income tax return depends upon several elements, including your earnings, deductions, and credit ratings. Consequently, working with an accountant is suggested since they can see every little thing to guarantee you get the maximum quantity of cash. Despite this, many individuals reject to do so since they assume it's nothing greater than an unnecessary expense.

The Only Guide to Pvm Accounting

When you employ an accounting professional, they can aid you stay clear of these errors and guarantee you get one of the most refund from your tax return. They have the expertise and knowledge to know what you're qualified for and just how to get the most refund - construction accounting. Tax period is commonly a difficult time for any kind of taxpayer, and for an excellent reason

Report this page